Digital advances deliver clearer picture of ad spending’s results

It’s just over five years since we started our company, S4 Capital, as a digital-only, data-driven advertising and marketing services disruptor and what’s surprising — against an external backdrop where we’ve had the Covid pandemic, Russia’s war in Ukraine, the return of inflation — is just how little the digital imperative has changed.

When we founded S4, we did so with four pillars at the heart of our model: we would be purely digital; we would focus on an iterative, data-driven model; our offer to clients would be “faster, better and cheaper”; and we would have a unitary structure with a single profit and loss account.

In today’s even stronger digital landscape, all those points of difference are as relevant as ever and while the market we’re in enjoys its ups and downs, and like everyone we are susceptible to the bigger economic picture, there’s no turning back on the inexorable progress of digital media, which is set to reach 70 per cent of all global advertising spend by 2025.

Agencies tend to say that the world has become more complex because it suits their book, but in my view the digital world has become simpler, because the six big platforms — Alphabet (Google, YouTube), Meta (Facebook, Instagram) and Amazon in the West; plus Alibaba, Tencent and ByteDance (which owns TikTok, the only really new platform entrant at scale) in China — have consolidated their position in the world’s media market and that provides six straightforward digital options for advertisers and their agencies.

Last year, Google accounted for about $225 billion of advertising expenditure, Meta for about $130 billion and Amazon for roughly $50 billion, out of a total spend of $650 billion outside China, which has its own ecosystem. They all grew strongly in the face of inflation and despite the cost of living crisis. In fact, the primary driver of that growth was inflation itself, since packaged goods companies, in particular, with strong brands were able to increase their prices to match cost increases. Their ad budgets increased by the same amount, as they largely employ fixed advertising-to-sales ratios, pretty much all of which was diverted to the big platforms, with legacy free-to-air networks suffering as a result.

Outbound Chinese companies also increased their advertising spending strongly as their companies started to expand globally post-Covid. The consequence is that last year Google was up about 12 per cent in terms of revenues, Meta by 20 per cent and Amazon by 25 per cent, while TikTok doubled its revenues outside China to $20 billion.

The other side of the equation is the decline of the non-digital world, best evidenced in what happened in 2023 to the television companies with programming schedules that used to control so much advertising. In the United States, those without a significant sport offering to buttress them saw ad revenues fall by 10 per cent to 15 per cent, while those with sport such as Fox and Disney were down more like 5 per cent.

Live sport remains a strong proposition — this year’s Super Bowl being a good example — helped by the Middle East’s sovereign wealth funds and, in particular, Saudi Arabia’s interest in football, golf, tennis, martial arts and so on, and the incursion of the streamers such as Amazon, Alphabet and Meta and Netflix into sports rights.

A further indication of the changing of the guard in TV is that the three biggest digital streaming platforms — Netflix, Disney and Amazon –– have all introduced advertising alongside subscription, as YouTube successfully modelled.

The much-delayed deprecation of third-party cookies, which now will take effect by the end of 2024, and Apple’s revamp of the identifier for advertisers from individual IP addresses to cohorts will not check the digital march. Brands’ increased focus on assembling and synthesising first-party, consumer-consented data, the use of platform signals, together with AI-enabled personalisation, will only accelerate the effective development of hyper-personalised advertising content.

What’s ironic for us is that the technology platforms, while enjoying stellar growth themselves in terms of advertising revenue over the last year, generally have cut their own advertising and marketing spending. That is largely down to the fact that they have instigated across-the-board cost-cutting after they over-hired during the pandemic. In the case of Meta, it was heralded as “the year of efficiency” and its market value sextupled in just over one year as a result. I expect that to continue into this year, but I also think it’s only a matter of time before technology advertising spending will come back.

One other reason the packaged goods companies have been pouring money into the platforms is that, in a geopolitical world that is so volatile, people are looking for short-term performance and short-term results. This means they’re less concerned about what we call upper funnel, or brand awareness, and are more concerned about mid or lower-funnel performance and activation work, where the results can be measured more effectively. In some cases, that has meant lower absolute levels of spending when interest rates were rising, but I think that advertisers overall will become less cautious as interest rates start to ease.

The game-changer in the past 12 months has been the rapid evolution and availability of AI and I think that makes the digital-only, data-driven model that we have pioneered even more relevant. We’ve identified five areas where AI is transforming how we work: visualisation and copywriting; hyper-personalisation at scale; media planning and buying; general efficiency in working practices; and what we call the democratisation of knowledge.

Only last week, OpenAI showed us and other creators an exciting new tool called Sora, which turns text into video. In one example, text is inputted that specifies a Japanese woman walking down a street against a backdrop of snowy mountains with snow falling and it immediately creates a film around that. It is in the early stages, of course, but tools such as this bring the process of creation down to seconds and will be incredibly valuable for us.

Alongside the six big platforms, there are other technology groups that are only going to get bigger and stronger: Microsoft, Apple and Nvidia come to mind, along with the software powerhouses such as Salesforce, Adobe and Oracle. Some of these companies are already bigger than countries and they are moving so rapidly that there is no way that regulators can keep up with them, so self-regulation is and will be key.

Looking to the future, I’m convinced that our model is every bit as relevant as it was in the beginning. The role for agencies in this world is going to be not only as a creator but also as a validator between advertisers and the media platforms. Clients are not going to want to invest their huge media budgets without impartial validation and evidence that it is being spent effectively.

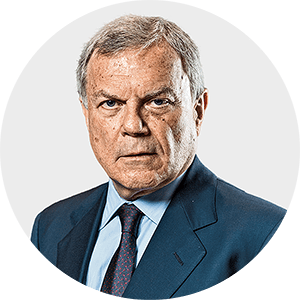

Sir Martin Sorrell is founder and executive chairman of the digital advertising and marketing services business S4 Capital